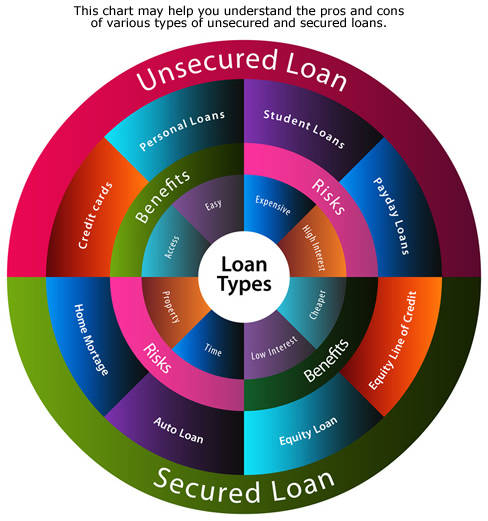

There are two main kinds of debts that we know, secured debt and unsecured debt. By examining the difference between the two types, it will give you better understanding the risk of borrowing money, loan, as well as for prioritizing debts and making sure keeping your assets.

In general, the main difference between the two categories is that unsecured debt is not backed up by any collateral/assets, whereas the secured debt is backed up by one. The lender assesses the consumer’s credit history before making a loan under either circumstance, however, in unsecured debts, creditworthiness is more vital to a lender giving out this type of debt. This is because unsecured debt is issued to a borrower with no collateral taken as security against non-repayment. Whereas the secured debts are those in which some asset is given up by the borrower as collateral with an assurance to pay back the debt.

http://www.debtsteps.com

Secured asset

On average, the secured debt financing is considered easy for most consumers to get. The lenders take on less risk by lending on terms that involve an asset held as collateral. Secured debts are tied to an asset that’s considered collateral for the debt. Lenders place a lien on the asset, giving them the right to take and sold the asset if you fall behind on your payments. And, if the selling price of the asset does not completely cover the debt, the lender may pursue you for the difference. This type of loan carries less risk for the lender, interest rates are usually lower for a secured loan.

The prime examples of secured debt are a mortgage and auto loan. Your mortgage loan is secured by your home. Likewise, your auto loan is secured by your vehicle. If you become delinquent on these loan payments, the lender can foreclose or repossess the property. A title loan is also a type of secured debt because you’ve tied your vehicle to the debt.

Normally, the lender places a lien, or financial interest, on the property until the loan is paying back in full. If the borrower defaults on the loan, the bank can seize the property and sell it to recoup the funds owed. Lenders often need the asset be maintained or insured under certain specifications to maintain the asset’s value. For instance, a mortgage lender requires the borrower to guard the property through a homeowner’s insurance policy. This secures the asset’s value for the lender until the loan is repaid. For the same reason, a lender who issues an auto loan requires certain insurance coverage so that in the event the vehicle is involved in a crash, the bank can still recover most, if not all, of the outstanding loan balance.

Unsecured asset

Just like its name unsecured debt is the opposite of secured debt, it requires no security for the loan. The unsecured loan is issued based exclusively on the borrower’s creditworthiness and promise to repay. Credit card debt is the most widely-held unsecured debt. Other unsecured debts include student loans, payday loans, medical bills, and court-ordered child support.

If a borrower fails to repay the loan, the lender can sue the borrower to collect the amount owed, but this can take a great deal of time, and legal fees can add up quickly. Therefore, banks typically charge a higher interest rate on these so-called signature loans. Also in this type of category, credit score and debt-to-income requirements are usually stricter for these types of loans, and they are only made accessible to the most convincing borrowers. Other examples of unsecured debts outside of loans from a bank include credit cards, medical bills and certain retail instalment contracts such as gym or tanning memberships. Credit card companies issue consumers a line of credit with no collateral requirements but charge heavy interest rates to validate the risk.

With unsecured debts, lenders do not have rights to any collateral for the debt. If you fall behind on your payments, they normally cannot take any of your assets for the debt. However, the lender may take other actions to get you to pay for delinquent debts. For instance, they will employ a debt collector to coax you to pay the debt. If that does not work, the lender may take legal action you and ask the court to garnish your wages, take an asset, or put a lien on another your assets until you have paid your debt. Another thing that they will do is reporting your delinquent payment status to the credit bureaus so it can be reflected on your credit report. Remember, lenders of secured debts take these actions, too.