Here is an idea of managing and investing the money to be able to work for current and future. There are many formulas available out there, as well as its variation, here with an example of a simple formula for creating wealth; in particular, where and how your money should be allocated.

www.moneyunder30.com

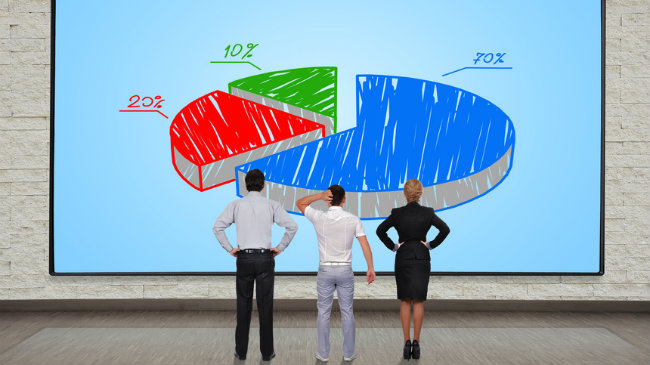

The 70/30 Rule

Take your monthly take-home income and divide it by 70% and 30% and divvy up the percentages as so:

- 70% is for monthly expenses (anything spends money on)

- 10% goes into savings unless you have pressing debt in which case it goes toward debt first.

- 10% goes to investments, retirement, saving for college

- 10% goes to donation/tithing

Expenses

Expenses include EVERYTHING you spend money on, including (but not limited to): bills, utilities, emergency or unexpected expenses, shopping, food, you name it. If you spend money on it, it’s considered an expense. It also includes your loans, if you have any such as the car or house loan.

Tips to make this work are

- 70% or less is the real key. If you don’t need to live off of 70%, then by all means, don’t! The less you spend, the more you can save and invest = the better life your family will have. 70% is the maximum.

- First, you need to find out what you’re currently spending. Pull up every dime you’ve spent the last 3 months (you read that right) and put it on a spreadsheet. Every dime, even if it’s $.50. Remember, every dime or this won’t work!

- Categorize the spending on the spreadsheet so you know at a glance what you’re spending money on (groceries…eating out…clothing…decor…bills…school fees, etc)

- Find the total of all spending (for all 3 months) and divide by 3, so you find a realistic average.

- Don’t have a credit card or bank statements because you pay cash for everything? That means you don’t have an accurate record of all spending, so you’ll need to start tracking every dime you spend for the next 3 months.

After you pay your taxes, learn to live on 70 percent of your after-tax income. Then, it’s important to look at how you allocate your remaining 30 percent. Let’s try allocating it to the following:

Charity

Of the 30 percent not spent, one-third should go to charity in some shape or form. I believe that contributing 10 percent of your after-tax income is a good amount to strive for. Start this habit early so it’s second nature before the big money comes your way!

Capital Investment

With the next 10 percent of your after-tax income, you’re going to create wealth. Use this money to invest, be it shares, property or business, even if only on a part-time basis.

Savings

The last 10 percent should be put in savings. Poor people spend their money and save what’s left. Rich people save their money and spend what’s left. It is important to become accustomed to seeing money in your bank account and not be tempted to spend it. Try to make 20% (at least). If you can spare more, sure, do more! Especially if you are paying off debt…put as much as you can spare toward it so you can be free and move on to bigger and better things.

So, remember that giving, investing and saving, like any form of discipline, has a subtle effect. At the end of the day, the week, the month, the results are hardly noticeable. But as time passes the results will be profound.