Are you having trouble to get a small business loan? Although it is difficult to get a small business loan with bad credit, it is not impossible because there are a number of alternative lenders who offer funding solutions for individuals with a bad credit history.

Gaining a small business loan with these lenders is still possible because they focus on more than your credit history to make decisions. They consider your operating history, revenue, potential, the strength of your business, and other operational parameters in your loan application.

Funding Options for Bad Credit Risks

But a bad credit isn’t something you can run away from, and even if you avoid it, it won’t disappear. One of the trick you can do is to fund your business in a way that really get your score back, so when you’re ready to move your business to the next stage, your score will start opening doors rather than acquiring them slammed in your face.

If your credit score holds you back from landing startup capital, you will appreciate these tips for finding the funding you need. The good news is, even though you have a bad credit history you can still launch a new business, if you take a number of important steps first.

1. Create a business plan

Every business needs a plan which should cover the type of business desired, the product or service offered, marketing to new customers, and also management. A financial counselor who specializes in business startups should be used to help you develop a business plan based on what resources are available to you including loans, guiding you through selecting a business name, applying for an employee identification number, state filing of paperwork, and licensing.

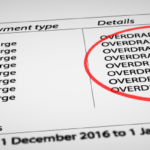

2. Check your credit

Get a copy of your credit score and your credit report. Review each report for accuracy, correct errors by following credit bureau guidelines to change that information.

According to Experian, one of the three credit reporting bureaus, most consumers have a credit score between 600 and 750, with a score of 700 or above indicating good credit management. A score below 600 means you will pay more for money borrowed if you can be approved for these loans in the first place.

Clean up your credit to help increase your score before starting your business if you anticipate your need to borrow money. Make it as your goal to wait until your credit scores have increased before looking for a loan to help launch your business. Once your score has increased, apply for a loan through your business name to separate your business and your personal accounts.

3. Consider to review your assets

With a business plan on your hand and a clear picture of how much funds you need to launch your business, you must review your assets to see what you can beat to launch your company. Retirement plans, Bank accounts, and equity in your home can be used to fund your small business, with lower interest rates on loans offered by lenders if you use your home as collateral.

For the smallest venture, such as the work at home parent, you may already have a computer, internet connection, and other basics to get started. Therefore, consider not borrowing money at this point.

4. Prepare your financial needs

Keep in mind that it is a map you are going to need. Not only include how much money you need initially, but also how much you’ will need later. Prepare your financial needs is important because almost every business has a negative cash flow after starting up.

Develop your business plan clearly. It is surprising how many new entrepreneurs fail to develop a business plan. You may be enthusiastic with your idea, but unless you can show it why and how your idea become a successful business, most lenders won’t approve your loan application. Try to develop both written and oral presentations that will appeal to prospective lenders. Entrepreneurs usually call it as “the pitch”. Keep in mind that a good pitch can make all the difference.

Learn and obtain One Loan from Lending Source

Actually, these first steps can be so scary, but they are very important to success in obtaining a loan.

1. Traditional Bank Loan

Bankers generally don’t like bad credit and they tend to hate new businesses. However, some community bankers may want to listen. If nothing else, you can practice your pitch. This option is tends to be unsuccessful because traditional lenders have limits on who they will finance.

Let say, it is impossible. Your interest rate will however be higher than a standard rate and additional guarantees may be needed for you than a traditional recipient.

2. Microloan

Microloan is similar to traditional bank loan, but they often come from alternative lenders such as credit unions. A microloan tends to be easier to obtain for those with substandard credit because the loan amounts, as the name suggests, are small, usually fifty thousand dollars or less. Therefore, the credit requirements for these loans are lower. If this amount of funding fits your needs, this is a good option.

Credit unions are another traditional lending source. If you don’t belong to a credit union, perhaps your partner, a close friend or family member does it and will be willing to sign together for the loan. Which may be will bring you to another important lending source: friends and family.

3. Friends and Family

If you have bad credit because you spend more than you make or generally careless about paying bills and making credit card payments, you can’t expect friends or family members to take risk for you. However, if special circumstances produced a low credit score, a difficult divorce case, for example then you have a reputation for following through when you make important life decisions, your friends and family may be willing to lend you the money, at least some of the money you need.

One way to achieve it is to ask them to sign with your loan. The co-signer is ultimately responsible, but you will make all loan payments directly to the lender, and all the payment reminders to come to you first.

If you have people in your life who can invest in your business, getting loans from friends and family is sometimes a choice. Of course, for many entrepreneurs who are just starting out and need cash, it isn’t a possibility. Either the amount they need is too high, or their circle of friends and family is small or maybe lacks their own money. It’s possible that your friends and family will find it too risky because of your bad credit as well.

4. Internet Lenders

The internet opens up a lot of business opportunities with one of them being an internet loan. Internet lenders tend to accept more risk than banks and put you through fewer circles when you apply for a loan. Two of the biggest are Prosper and Lending Club. The book “Peer Finance 101” succeeded to lists 20 more. With bad credit, you might be able to get a loan, but it will come with a higher-than-average interest rate.

5. Crowdfunding

Crowdfunding is an remarkable internet success story. If you have a killer idea and no money to deal with, crowdfunding may be your answer. Essentially, you use the internet to throw hundreds and sometimes thousands of people to motivate them to lend or donate the money you need to carry out your idea.

The biggest crowdfunding organization is IndieGoGo, which has increased more than $1 billion for the beginner entrepreneurs. The IndieGoGo website has a short pamphlet that explains how exactly crowdfunding works. Besides IndieGoGo, there are many larger crowdfunding organizations, some of which specialize in lending in certain fields: social responsibility, real estate, women and minorities, artists, and others.

6. Merchant cash advance

Also called as a business cash advance, this option is only applies to those who have cash flow problems who will need ten thousand dollars or less. Cash advance usually has very high interest rate which means that you will almost certainly pay more in the long run than the initial loan, especially if you miss payments. Make sure you can repay on time before going to this route.

7. Home equity credit line

Also known as “betting the farm,” it is an extremely high-risk option, and only applies to those who own houses. In other words, you put up your house as collateral to get a bank loan.

8. Revenue-based loan

This type of loan has a specific set of recipients: you must have a credit score of over 550, your company must generate more than a hundred thousand per year in sales, and the loan amount can not exceed ten percent of your revenue. You can receive this type of loan in just one week. If you meet these criteria, you can learn more here.

Is the money worth the risk?

Itis reasonable to consider whether these options are worth the possibility bad effects down the road. Of course, for some business owners, not getting more financing as soon as possible can mean having to take drastic actions, even closing the business. The silver lining here is that most of the above will help restore your credit if you keep in good reputation and make on-time payments. There is a warning: if you can’t make on time payments, these options will sink your business into debt and worsen the problem.

If you have a bad credit but you don’t need immediate financing, these options might not sound attractive to you, or the risks might seem too high. In both case, working to restore your credit is key to the success of your business.

What should you do to restore your credit?

If it is time to be inactive to get a loan, make sure that it is only temporary. What you should do is increase your credit, and here’s how it will work.

1. Understand how credit works

There is a business credit score, which factors in things like whether your business makes late payments or debt. Keep in mind that as a business owner, you are basically the credit representative of your company. Your personal credit score, regarding things from credit cards to car payments, is a big factor when a bank decide whether to lend or not. Don’t be discouraged; there are always positive things you can do to build up your credit.

2. Start small, with the basics

If you personally have bad credit, make sure personal expenses and business are separated. Contact you collections agencies and prepare what regular payments you can really afford. It will be good to pay all bills on time or early.

3. Combine your business

If you haven’t already done so, make sure there is a bill under the company name where you made a good track record.

4. Prepay everything you can

Not only does prepaid bills often guarantee you a discount, when it comes to your credit, but also the more things that are already squared away and paid for, the better.

5. When you ask for funding, ask for the smallest possible amount to cover your needs

This will increase your chances to get a loan and be able to pay it back. You don’t want to burden yourself with more debt than you need, and of course, you don’t want to end up with a big debt you can’t afford to repay.

Planning for the future

There are may be understandable reasons for your bad credit. Most of us still bounce back from recession, and some businesses were hit harder than others. Whether you decide to get a “bad-credit loan,” or not, building up your credit is planning for the future of your company. Once you increase your credit score, it will be much easier for you to get funding as your company grows.

Once your business has been established and you make money very well, apply for a merchant cash advance. Most of merchant cash advance lenders are less concerned about bad credit than traditional lenders.