The quick answer for that is no, under exceptional circumstances. You are not and will not responsible for your future spouse’s bad credit or debt unless you decide to take it on by getting a loan jointly to pay off the debt. However, your future spouse’s credit problems can prevent you from getting credit as […]

Good Debt Ratio?

It is widely accepted that having debt can help us to grow our business, or in term of personal finances, it can assist to fulfil needs. Why this important to know the debt ratio? And also why we need to know whether is it falls into a good or bad category? The debt ratio commonly […]

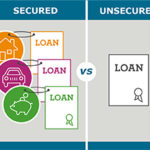

Secured and Unsecured Debt: What’s the Difference?

There are two main kinds of debts that we know, secured debt and unsecured debt. By examining the difference between the two types, it will give you better understanding the risk of borrowing money, loan, as well as for prioritizing debts and making sure keeping your assets. In general, the main difference between the two […]

Why do We Need to Consolidate Credit Card Debt?

More people have more access to credit card and it means credit card debt is growing. Based on the case in the US, the average household with debt carries $15,762 in credit card debt. Furthermore, the average interest rate is 13.70%, which means American families could pay more than $2,000 of interest over the next […]

What is the Difference Between APR and APY?

The two terms confusing concepts of Annual percentage rate (APR) and annual percentage yield (APY) often used a lot in banking and financial industry. Having the understanding of the difference of these two can assist you in making better and more informed financial decisions. Whenever comparing APR vs. APY it refers to the periodic interest […]

Payday Loans and Cash Advances: What are the Differences?

Both are types of personal loans but they are different. Payday loans and cash advances are typically considered to be short term loans that are taken out to help with some sort of immediate expense like paying for an emergency or past due bills. Payday Loans Payday loans are also known as “online personal loan” […]

How Can I Get a Standby Letter of Credit?

Financing small business is not always easy to come, however, it is essential to look down every possibility. Standby letters of credit can help business in tough contractual and financial situations, making investors more likely to sign contracts and do business. How powerful this avenue? Let’s explore further. A standby letter of credit (SLOC) is […]

What are Mortgage-Backed Securities (MBS)?

The quick answer for Mortgage-backed securities or MBS are bonds secured by home and other real estate loans. A mortgage-backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages. This security must also be clustered in one of the top two ratings as determined by an […]

How to Raise FICO Score?

In finance, FICO score is a person’s credit score calculated with software from Fair Isaac Corporation (FICO). Improving FICO credit score means improving chances of obtaining a mortgage, but it could improve auto insurance premiums and, possibly, making a person a more attractive employment candidate. FICO scores range from 300 to 850. Mortgage applicants get the […]

Ways to Pay Off Any Loan Faster

Whether it is consumer debt on credit cards, student loans or a mortgage, most people find themselves weighed down by debt at some point in their lives. Having this financial burden will add more stress in life. By paying loan faster it will definitely help to reduce the pressure. Here are steps that can ease […]