The simplest way to boost your investment returns while reducing risk is diversification. You may think that it is an impossible investing goal, but it’s actually a simple yet important, especially if you are new and aim for becoming passive investors.

Diversification means owning a range of assets across a variety of industries, company sizes and geographic areas. Partly it is called asset allocation, meaning how much of a portfolio is invested in various asset classes. Investors have many options, and each has advantages and disadvantages, responding differently across the economic cycle.

Owning a variety of assets minimises the chances of any one asset hurting your portfolio. The trade-off is that that you never fully capture the startling gains of a shooting star. The net effect of diversification is slow and steady performance and smoother returns, never moving up or down too quickly. That reduced volatility puts many investors at ease.

While diversification is an easy way to reduce risk in your portfolio, you must remember that it can’t eliminate the risk itself. Investments have two broad types of risk:

- Asset-specific risks

These risks come from the investments or companies themselves. Such risks include the success of a company’s products, the management’s performance and the stock’s price.

- Market risks

These risks come with owning any asset, even cash. The market may become less valuable for all assets, due to investors’ preferences, a change in interest rates or some other factor such as war or weather.

Generally, you can radically lessen asset-specific risk by diversifying your investments. However, do what you might, there’s just no way to get rid of market risk via diversification. It’s a fact of life.

You won’t get the benefits of diversification by stuffing your portfolio full of companies in one industry or market. Remember, to reduce company-specific risk, portfolios have to vary by industry, size and geography. Here are steps to do it.

1. Know target investment mix

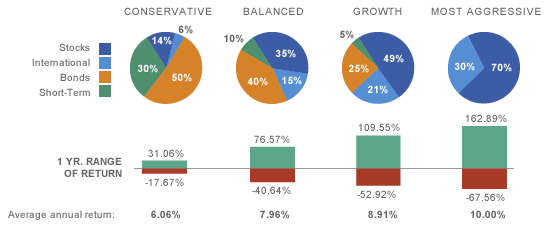

Choose a mix of stocks, bonds, and short-term investments that you consider appropriate for your investing goals. Your portfolio should be spread among many different investment vehicles such as cash, stocks, bonds, mutual funds, and perhaps even some real estate. Take into account financial situation, tolerance for volatility, and when you will need the money you are investing. Stocks have historically had the higher potential for growth, and longer time periods can help to smooth out volatility.

http://luminfinancial.com/the-importance-of-a-diversified-portfolio-2/

On the other hand, if you’ll need the money in just a few years consider a higher allocation to generally less volatile investments such as bonds and short-term investments. By doing this, of course, you’d be trading the potential of higher returns for the potential of lower volatility.

2. Review portfolio regularly

We suggest either on your own or in partnership with an investment professional, monitoring asset mix at least annually, or whenever financial circumstances change and rebalance the portfolio to correct for significant drift away from the mix you choose. As a guideline, you may want to consider rebalancing if your stock allocation moves away from your target by more than 10 percentage points.

3. Rebalancing when needed

There are a variety of ways to rebalance your portfolio. One is to sell those asset classes you currently have too much of and reinvest the proceeds in those that fall short of your target. But selling securities in taxable accounts generally has tax consequences in the year of a sale, so be sure to consider taxes when making any decisions to sell. A way to rebalance without immediate tax consequences is to invest any new money you have (savings contributions, bonus, etc.), either gradually or all at once, in investments in asset classes that currently fall below your target.