Financial institutions such as banks that provide loans and credits normally asked both individual and business borrowers to provide information related to their credit history, income and debt when applying for credit. They use the Five Cs system to evaluate the potential borrowers. The financial institutions as lenders, in particular, are eager to research and examine the possibility and minimase the risk of default. The system weighs five characteristics of the borrower and conditions of the loan, attempting to estimate the chance of default or failure. The five C’s of credit stands for character, capacity, capital, collateral and conditions.

This technique of evaluating a borrower is involving both qualitative and quantitative measures. The lenders look at a borrower’s credit reports, credit score, income statements and other documents relevant to the borrower’s financial situation, and they also consider information about the loan itself.

Character

In short, the character refers to the borrower’s reputation, the track record for repaying debts. It sometimes called credit history. It will examine the educational background, employment, past reports and etc. The credit reports contain detailed information about how much an applicant has borrowed in the past and repayment is done on time. These reports also contain information on collection accounts, judgments, liens and bankruptcies, and they retain most information for seven years. If a borrower has not managed past debt repayment well or has a previous bankruptcy, his character is deemed less acceptable than a borrower with a clean credit history.

Capacity

Capacity measures a borrower’s ability to repay a loan based on the proposed amount and term by comparing income against recurring debts and assessing the borrower’s debt-to-income (DTI) ratio. For the individual case, in addition to examining income, lenders look at the length of time an applicant has been at his job and job stability. Individual borrowers provide detailed information about the type of income earned as well as the stability of their employment. For business loan applications, the financial institution reviews the company’s past cash flow statements to determine how much income is expected from operations. Capacity is also determined by analyzing the number and amount of debt obligations the borrower currently has outstanding compared to the amount of income or revenue expected each month.

Capital

In the capital evaluation, the lender will consider any capital (money) the borrower puts towards a potential investment because a large contribution by the borrower will lessen the chance of default. The calculation informs lenders of additional savings, investments or other assets that could be used if a borrower lost employment or business revenue. Capital for a business loan application consists of personal investment into the business, retained earnings and other assets owned by the business owner. For personal loan applications, capital consists of savings or investment account balances. Lenders view capital as an additional means to repay the debt obligation should income or revenue be interrupted while the loan is still in repayment.

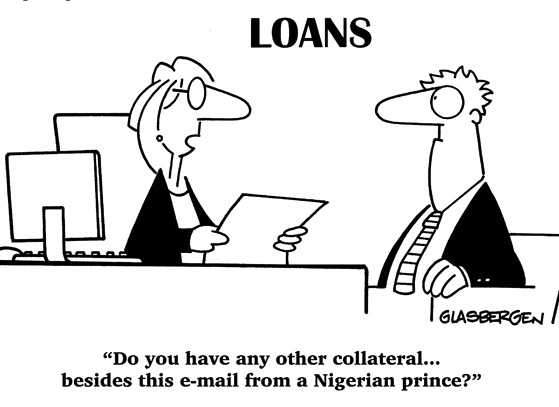

Collateral

Collateral refers to such as property or large asset, that helps to secure the loan. If the loan is against real estate then the quality of the property is a major consideration. It gives the lender the assurance that if the borrower defaults on the loan, the lender can repossess the collateral. For example, Business borrowers may use equipment or accounts receivable to secure a loan, while individual debtors often pledge savings, a vehicle or a home as collateral.

http://cienegasolutions.com

Conditions

The conditions of the loan, such as the interest rate, the term, principal reduction (amortization) and amount of the loan, will influence the lender’s desire to finance the borrower. Conditions refer to how a borrower intends to use the money. For example, if a borrower applies for a car loan or a home improvement loan, a lender may be more likely to approve those loans because of their specific purpose, rather than a signature loan that could be used for anything. Knowing what financing will be used for, such as equipment or working capital, provides lenders with a better understanding of the risk they are taking on.

Although each financial institution has its own variation of the process to determine creditworthiness, most lenders put the greatest amount of weight on a borrower’s capacity. Borrowers who have high marks in each category are more apt to receive a lower interest rate and more favorable repayment terms than less creditworthy borrowers.