It is widely accepted that having debt can help us to grow our business, or in term of personal finances, it can assist to fulfil needs. Why this important to know the debt ratio? And also why we need to know whether is it falls into a good or bad category?

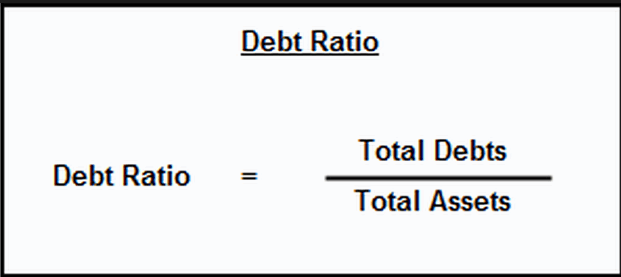

The debt ratio commonly is calculated from the total debt divided by total asset or income. The debt ratio is an important number to keep an eye on. That is because it tells a lot about the status and how precarious financial situation is. To exemplify when related to your income, suppose your debt is 60% of your income, any hit to your income will leave you scrambling. From the perspective of creditors and lenders, the debt to income is an important measure of risk. People with higher debt-to-income ratios are more likely to default on their mortgages and other debt. In fact, when applying for a mortgage, calculating debt to income ratio will be part of the mortgage underwriting process.

http://www.advisoryhq.com

Often, businesses take on debt even when they have assets that could pay for their expenses when they know they can get a better rate of return on the borrowed money than what they are paying out in interest. The leverage the borrowed funds create and allow investors to have a greater amount of return on their money. Therefore, not all debt is necessarily bad debt. However, too much debt can be a sign of instability. This information can be used by the investors to consider whether it is worth to invest in a business.

In general, we all have a sense that more income and less debt are both good things. But what is the ideal ratio between income and debt? The context could probably be pretty broad, but here are some guidelines:

- Debt to total assets should be less than 30%. For every dollar of assets, you should have 30 cents or less of total debt payments.

- Housing debt should be less than 28%. For every dollar of gross income (for the household) your principal and interest (for your mortgage) should be at or less 28 cents. If you combine all debt payments you would ideally want those to be 36 cents or less (per dollar) of your gross income.

- For income, the general rule is a ratio at or below 36%. The 36% Rule states that your Debt to Income should never pass 36%. The general rule the lower the better, so if you can manage finances in such a way that your debt to income is, say, 18%, so much the better.

Again, these are just best practices guidelines. But they allow for you to save at least 10% of your gross income for future savings goal (e.g. retirement, education, etc.) So anything within those guidelines would correspond to a “good” debt ratio.

In term of business, according to the Finance Owl, a higher debt ratio can be interpreted as a higher risk for investors, but it can also a higher amount of leverage, especially since some interest payments can be written off on tax statements. Because there is no hard and fast rule about what is considered a good debt ratio vs. a bad debt ratio, investors should always seek professional consultation whenever possible before making any investment decisions. In general, debt ratios tend to differ from one industry to the next. Therefore, wise investors often compare the debt ratio of one company to another in the same industry to determine whether the debt ratio should be judged as either good or bad.

In conclusion, the debt ratio is an important measure of financial security, either personal or business wise. The lower it is, the more affordable the debts are.