Financing small business is not always easy to come, however, it is essential to look down every possibility. Standby letters of credit can help business in tough contractual and financial situations, making investors more likely to sign contracts and do business. How powerful this avenue? Let’s explore further.

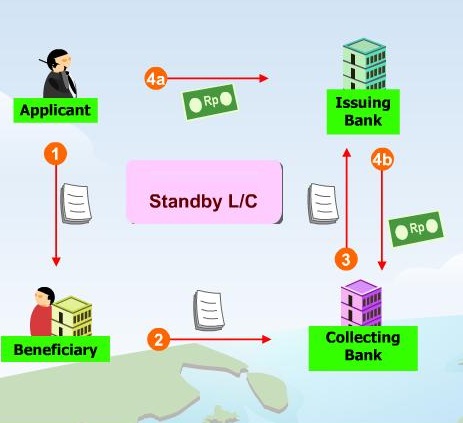

A standby letter of credit (SLOC) is a guarantee of payment issued by a bank on behalf of a client. It is the last resort loan in which the bank fulfils payment obligations by the end of the contract if their client fails to fulfil a contractual commitment with a third party. The standby letter of credit is never meant to be used, but prevents contracts from going unfulfilled in the event your company closes down, declares bankruptcy, or is unable to pay for goods or services provided. Standby letters of credit help prove a business’ credit quality and repayment abilities and a sign of good faith in business transactions.

Small businesses frequently face difficulty when securing financing. By having standby letters of credit may be especially beneficial for encouraging investors to lend money to a company. In the case of default, investors are assured they will be paid principal and interest from the bank through which the SLOC is secured.

http://www.plutuscapitaladvisors.com

Types of SLOC

There are two types of Standby Letters of Credit, Performance SLOC and Financial SLOC. Performance SLOC is Performance standby letters of credit ensure the nonfinancial contractual obligations (quality of work, the amount of work, time, cost, etc.) are performed in a timely and satisfactory manner. If these obligations are not met, the bank will pay the third party in full. For example, a contractor guarantees a construction project will be finished in 90 days. If work remains incomplete after the 90-day period, the client can present the SLOC to the contractor’s bank and receive the payment due.

The Financial SLOC is Financial standby letters of credit ensure financial contractual obligations are fulfilled. Most SLOCs are financial. Financial SLOCs are often necessary when performing the international trade or other large purchase contracts under which other forms of payment protections (such as litigation in the event of non-payment) can be difficult to obtain. For example, an exporter sells goods to an overseas buyer who guarantees payment in 30 days. When the payment does not appear by the deadline, the exporter presents the SLOC to the importer’s bank and receives the payment.

Obtaining a Standby Letter of Credit

In general, the standby letter of credit process is similar to obtaining a commercial loan, with a few principal differences. As with any business loan, you will need to provide proof of your creditworthiness to the bank. Collateral may be required to protect the bank in case of default. However, the SLOC approval process is much quicker, with letters often being issued within a week of all paperwork being submitted.

Unlike traditional loans, the bank will require a standby of letter of credit fee of between 1-10% of the SLOC value before issuing the letter. This fee is usually charged per year that the letter of credit is in effect. If the terms of the contract are fulfilled early, the SLOC cancellation can be done without incurring additional charges.

Standby letters of credit can help establish trust with your business partners and be a powerful tool to help meet your business goals. Talk with your banker about how you can use a standby letter of credit for your business.