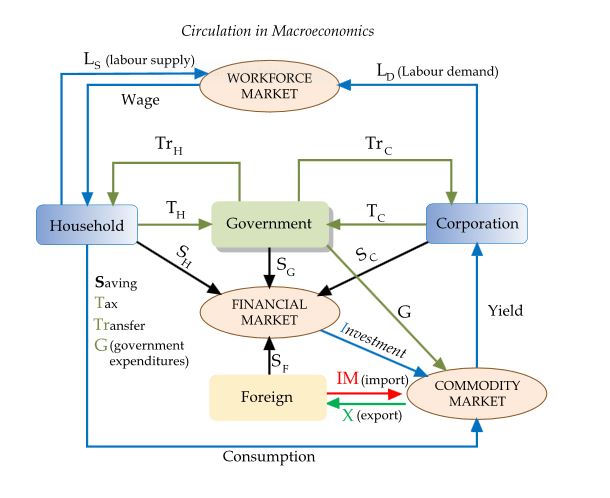

Macroeconomics is looking at concepts like industry, country, or global economic factors, or it can be concluded that it refers to the ‘big picture’ study of economics. Macroeconomics is a branch of economics that focuses on the behavior and decision-making of an economy as a whole. In the surface, macroeconomics simplifies the complexities of the trading activities in an economy by distilling actions to primary participants and tracing the circular flow of activity between them. Macroeconomics involves looking at concepts like a nation’s Gross Domestic Product (GDP), unemployment rates, growth rate, and how all these concepts and indicators interrelate with each other.

Some of the key points in the macroeconomic are as follows.

- Macroeconomists study aggregated indicators such as GDP, unemployment rates, and price indices to comprehend how the whole economy functions.

- Macroeconomists build up models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, savings, and investment, government spending as well as international trade.

- Macroeconomics encompasses a variety of concepts and variables, and there are three central topics for macroeconomic research on the national level: output, unemployment, and inflation.

At the government level, studying and applying macroeconomics is extremely vital because policy and economic decision and regulations enacted by the government can have a major impact on many aspects of on the whole economy.

To exemplify, how interest rates fit into macroeconomic policy and to show macroeconomic theory into practice. Many studies go into establishing the appropriate interest rates in an economy, where the government sets a base rate and banks work from there. If interest rates go up then people may save more money as they get a better return on their deposits. Then, business will invest in less expansion as borrowing money will cost relatively more. The local currency will go up in value because now deposits in that currency can earn more compared to other currencies. Inflation will go downward because in general saving is up and spending is down and people are buying less.

On the contrary, it would be expected for each point if interest rates go down.

This gets very complex because ‘relatively go up’ or ‘relatively go down’ are very loose relationships and many factors impact decision making also (i.e. taxes & employment rates). In macroeconomic, the impact of the policy decisions of other countries has to be considered also as they impact what happens to a countries economy also.

In theory or on paper, macroeconomics can be easy because for each change in a relevant figure it can be assumed that if all other factors are constant, this is what would happen. In reality, all of the factors are constantly shifting and enacting macroeconomic policy is very difficult to manage.

While macroeconomics is a broad field of study, there are two areas of research that are especially well publicized in the media: the evaluation of the business cycle and the growth rate of the economy. As a result, macroeconomics tends to be broadly cited in discussions related to government intervention in economic expansion and contraction, as well as, with respect to the evaluation of economic policy.

Despite macroeconomics encompasses a variety of concepts and variables, it has especially three central topics for macroeconomic research on a national level: output, unemployment, and inflation. Apart from macroeconomic theory, these topics are also extremely central to all economic agents including consumers, producers, and workers.