Both are types of personal loans but they are different. Payday loans and cash advances are typically considered to be short term loans that are taken out to help with some sort of immediate expense like paying for an emergency or past due bills.

Payday Loans

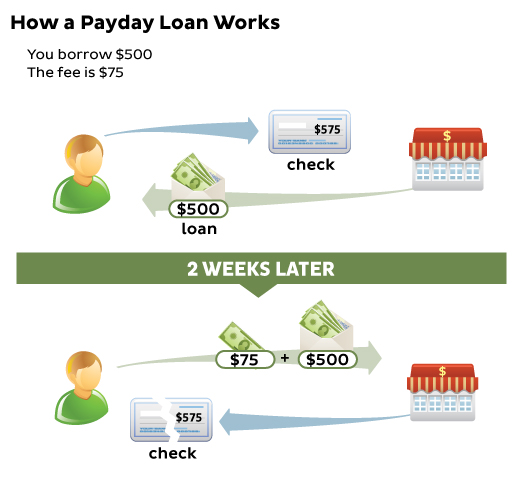

Payday loans are also known as “online personal loan” or “payday advances.” In the simplest explanation, a payday loan is basically an advance on your upcoming wages. So if you have suffered a blown car tyre, for instance, and need to access salary before pay day, this can be the perfect option. This type of loan is intended so that the return payment within a matter of days and no longer than a few weeks. If unable to meet those demands, high-interest rates will be applied.

www.consumer.gov

Cash Advances

Some people use cash advance and payday loans interchangeably and there are some fundamental similarities. There are basically three types of cash advances. One type of cash advance is structured similarly to a payday loan or a personal loan in that the amount borrowed is based on the income. They are also designed to be repaid in a month or when you get your next paycheck.

Another type of cash advance is based on the line of credit or a credit card. Instead of being based on income, it is based on the available credit on the credit card. It is treated more like a purchase that you make with your card and the repayment procedure is defined by the credit card policies and terms.

The third cash advance is obtained directly from your employer. In most cases, employers do not charge extra fees or interest but take the money out of your subsequent checks. This is the least common type of cash advance.

The differences

Payday loans are usually paid through bank transfer, and can often hit your account within an hour. As for cash advances, you will be using your credit card to access funds. So if there is an ATM around, you will be able to withdraw those funds immediately.

Payday loans lenders know that not everyone will pay up, which is part of the reason that the interest fees are so high. Whereas in the cash advances on a credit card can have a very high-interest rate and carry an immense transaction fee. Any ATM can be used to get your cash advance but the ATM may also charge you another fee. The interest is the risky part of a cash advance on a credit card. Sometimes the credit card company separates the balances from purchases and a cash advance but the monthly payment can be applied to both of the balances. If a borrower only pays the minimum required payment, credit card companies are allowed to apply the payment to the balance that has the lower interest rate. Before taking out a cash advance, always check the features, terms and conditions of the card.

Payday loan companies usually work with standard borrowing amounts. The minimum amount borrowed can often be as little as £50 while the maximum is often set to £1,000. The total amount that you can borrow usually depends only on your income and your next check. Most sites require you to make at least $1000 a month to extend you a line of credit. Those who make more than $1000 per month may be able to borrow more as long as they can verify their income. on the contrary, the cash advance system can be a little more flexible. Many credit card issuers will determine an individual’s amount against their current credit limits.

Which one better?

Cash advance and payday loans can both be incredible ways to overcome temporary money problems. Whether it is fixing a problem in the home or clearing a high-interest debt fast, short-term borrowing is an ideal solution. However, it is always imperative to make the right financial decision for you. If you need money fast and do not already have a credit card issuer, you may want to look at payday loans. Just remember that paying it back promptly is crucial. But if you need a small amount of cash in an emergency, using a cash advance from your credit card issuer is probably the best option available. This option allows quick access without opening accounts with new lenders. Not only does this make the repayment management a little easier, but it also hands you a little-added flexibility.