Assets are anything having some value, which is owned by an individual or firm and is expected to provide economic benefit in future. It is the fundamental business prerequisite that is needed by the company for its smooth functioning. Assets are largely classified as non-current assets and current assets. Non-current assets are further divided into tangible and intangible assets. To obtain more understanding the difference of both here is further the explanation.

Tangible assets

Tangible assets are physical assets such as land, vehicles, equipment, machinery, furniture, inventory, stock, bonds and cash. These assets are the backbone of a company in order to operate daily but are not available to customers. Tangible assets are at risk of damage either from naturally occurring incidents, disasters, theft or accidents.

The two types of tangible assets are current and fixed. Current assets are inventory or items a company turns into cash usually by the end of the year. These assets can be used as liquidation to save a company from short-term debt problems or as financial aid. Fixed assets are physical items that will not be sold at any point in the business. These assets include machinery, equipment, vehicles or land, and they are needed to run the business continually.

Intangible assets

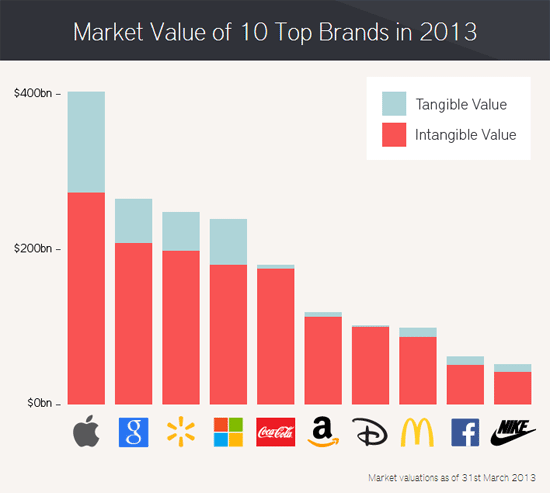

Intangible assets are nonphysical, such as patents, trademarks, franchises, goodwill, and copyrights. Depending on the type of business, intangible assets may consist of Internet domain names, performance events, licensing agreements, service contracts, computer software, blueprints, manuscripts, joint ventures, medical records, permits, and trade secrets. Intangible assets add to a company’s possible future worth and can be much more costly than its tangible assets.

The points given below are worth mentioning, so far as the difference between tangible and intangible assets is concerned:

- An asset acquired by the firm which is having monetary value and is materially present is called tangible assets. Incorporeal assets which have a certain useful life and an economic value is called intangible assets.

- Tangible assets are the assets which are present with the company in their physical form. On the other hand, intangible assets are the assets which so not exist physically rather they are abstract.

- While the decrease in the value of tangible assets is termed as depreciation, whereas intangible assets are amortised.

- Due to the material presence of tangible assets are readily exchangeable into cash in case emergency. Conversely, it is a bit tricky to sell intangible assets.

- Tangible assets have salvage value; however intangible assets do not have salvage value. Salvage value is the residual or scrap value of the asset after it is entirely depreciated.

- Tangible assets are widely accepted by the lenders while granting a loan to the firm. As against this, intangible assets cannot be used by the firm as collateral to raise loans.

http://www.myassettag.com/business-assets

Both tangible and intangible assets are recorded and written on a balance sheet. A balance sheet outlines a company’s balance of income and spending over time to determine its debt to equity ratio. To give more understanding into the context, for the quarterly period ended April 1, 2017, Apple, Inc. (AAPL) recorded total goodwill and acquired intangible to be worth $8.09 billion and Net Property, Plant and Equipment (PP&E) worth $27.16 billion. The balance sheet allows a company to assess future expansion and gives banks, investors, and vendors the ability to decide a company’s worth of possible loans or credits.