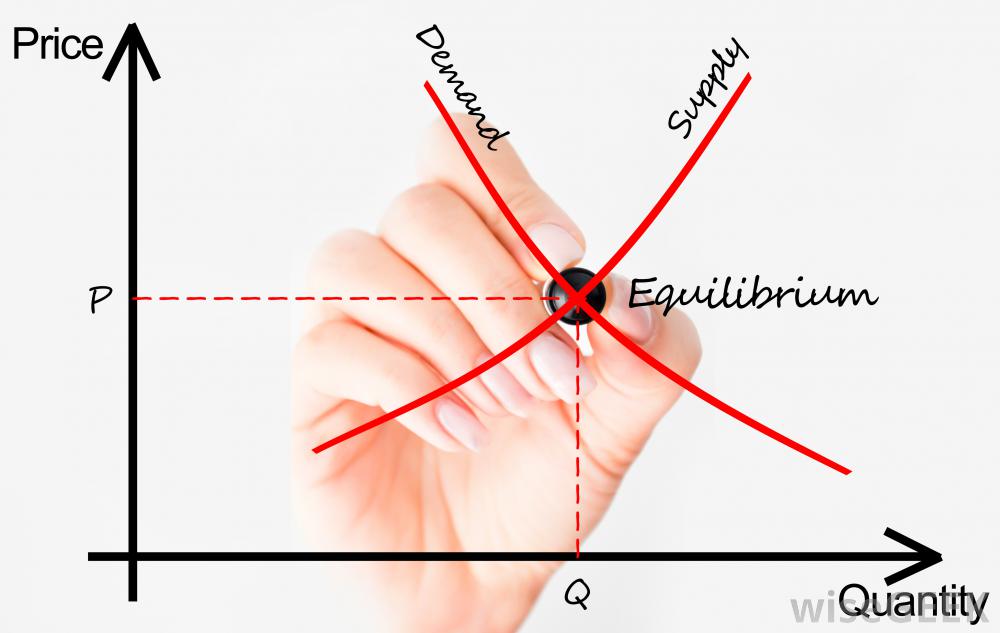

Market equilibrium refers to the stage where the quantity demanded for a product is equal to the quantity supplied for the product. The price when the quantity demanded is equal to the quantity supplied for the product is known as the equilibrium price. Equilibrium price is also termed as market clearing price, which is referred to a price when there is neither an unsold stock nor an unsupplied demand.

The market price refers to a current price at which a product is sold in the market. It is determined by the collaboration of two functions, namely, demand and supply. Supply and demand are perhaps one of the most fundamental concepts of economics and it is the backbone of a market economy.

Demand refers to how much (quantity) of a product or service is desired by buyers. The quantity demanded is the amount of a product people are willing to buy at a certain price; the relationship between price and quantity demanded is known as the demand relationship. Supply represents how much the market can offer. The quantity supplied refers to the amount of certain good producers are willing to supply when receiving a certain price. The correlation between price and how much of a good or service is supplied to the market is known as the supply relationship. Therefore, the price is a reflection of supply and demand.

The relationship between demand and supply underlie the forces behind the allocation of resources. In the market economy theories, demand and supply theory will allocate resources in the most efficient way possible.

According to economic theory, the market price of a product is determined at a point where the forces of supply and demand meet. When supply and demand are equal (i.e. when the supply function and demand function intersect) the economy is said to be at equilibrium. The point where the forces of demand and supply meet are called equilibrium point. Conceptually, equilibrium means the state of rest. It is the stage where the balance between two opposite functions, demand and supply is achieved.

At this point, the allocation of goods is at its most efficient because a number of goods being supplied are exactly the same as a number of goods being demanded. Thus, everyone (individuals, firms, or countries) is satisfied with the current economic condition. At the given price, suppliers are selling all the goods that they have produced and consumers are getting all the goods that they are demanding.

In the real market place equilibrium can only ever be reached in theory, so the prices of goods and services are constantly changing in relation to fluctuations in demand and supply.

Some of the causes of disequilibrium are excess supply and excess demand. In the case of excess supply, this situation happens if the price is set too high, excess supply will be created within the economy and there will be allocative inefficiency. The suppliers are trying to produce more goods, which they hope to sell to increase profits, but those consuming the goods will find the product less attractive and purchase less because the price is too high.

Whereas in the situation of excess demand, it is created if the price is set below the equilibrium price. Because the price is so low, too many consumers want the good while producers are not making enough of it. Thus, there are too few goods being produced to satisfy the wants (demand) of the consumers. However, as consumers have to compete with one other to buy the good at this price, the demand will push the price up, making suppliers want to supply more and bringing the price closer to its equilibrium.