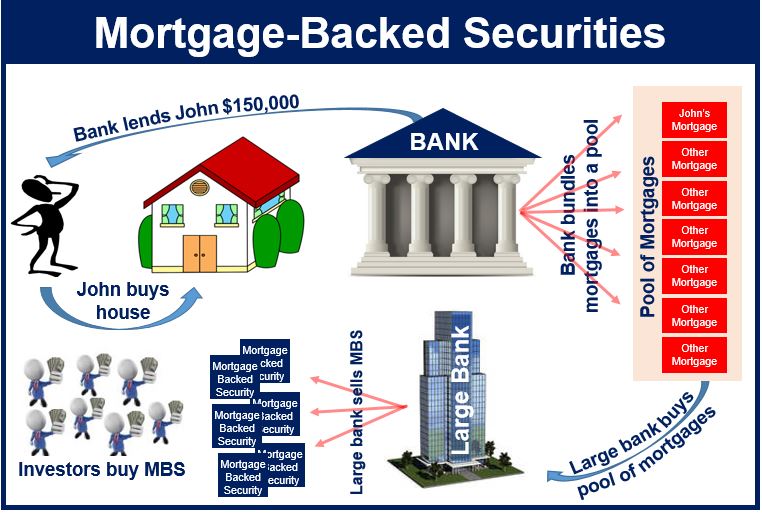

The quick answer for Mortgage-backed securities or MBS are bonds secured by home and other real estate loans. A mortgage-backed security (MBS) is a type of asset-backed security that is secured by a mortgage or collection of mortgages. This security must also be clustered in one of the top two ratings as determined by an accredited credit rating agency, and usually, pays periodic payments that are similar to coupon payments. Furthermore, the mortgage must have come from a regulated and authorized financial institution.

http://marketbusinessnews.com/financial-glossary/mortgage-backed-securities/

For example, a bank offering home mortgages might value $10 million worth of such mortgages. That pool is then sold to a federal government agency like Ginnie Mae or a government-sponsored-enterprise (GSE) such as Fannie Mae or Freddie Mac, or to a securities firm to be used as the collateral for the new MBS.

An MBS is also branded as a “mortgage-related security” or else a “mortgage pass-through.” An MBS can be bought and sold through a broker and the minimum investment varies between issuers. It is issued by either a federal government agency company, the government-sponsored enterprise (GSE), or private financial company.

An MBS hold the guarantee of the issuing organization to pay interest and principal payments on their mortgage-backed securities. While Ginnie Mae’s guarantee is backed by the “full faith and credit” of the U.S. government, those issued by GSEs are not.

The third group of MBSs is issued by private firms. These “private-label” MBS are issued by subsidiaries of investment banks, financial institutions, and homebuilders whose credit-worthiness and rating may be much lower than that of government agencies and GSEs.

Due to the general complexity of MBS, and the difficulty assessing the creditworthiness of an issuer, most companies that intend to invest in this, use caution when investing. They may not be proper for many individual investors.

Most MBS bondholders obtain monthly—not semiannual— interest payments which make this differ from a traditional fixed-income bond. Homeowners whose mortgages make up the underlying collateral for the MBS) pay their mortgages monthly, not twice a year. These mortgage payments are what ultimately find their way to MBS investors.

Here are some of the most common types of mortgage-backed securities:

- Pass-Throughs:

This is the most basic mortgage securities. They are a mechanism—in the form of a trust—through which mortgage payments are collected and distributed (or passed through) to investors. The majority of pass-throughs have stated maturities of 30 years, 15 years and five years. While most are backed by fixed-rate mortgage loans, adjustable-rate mortgage loans (ARMs) and other loan mixtures are also pooled to create the securities. Because these securities “pass through” the principal payments received, the average life is much less than the stated maturity life and varies depending upon the pay down experience of the pool of mortgages underlying the bond.

- Collateralized mortgage obligations

This type is normally Called CMOs for short, These are a complex type of pass-through security. Instead of passing along interest and principal cash flow to an investor from a generally like-featured pool of assets (for example, 30-year fixed mortgages at 5.5 percent, which happens in traditional pass-through securities), CMOs are made up of many pools of securities. In the CMO world, these pools are referred to as tranches or slices. There could be scores of tranches, and each one operates according to its own set of rules by which interest and principal get distributed. If you are going to invest in CMOs—an arena generally reserved for sophisticated investors—be prepared to do a lot of homework and spend considerable time researching the type of CMO you are considering (there are dozens of different types), and the rules governing its income stream. Many bond funds invest in CMOs on behalf of individual investors.