ROI or Return on Investment is performance measure used to compare efficient of a number different investment or to evaluate the efficiency of an investment. The amount of return on an investment relative to the investment’s cost is measured by ROI. An investor cannot evaluate any investment, whether it’s a stock, bond, rental property, collectable or option, without first understanding how to calculate return on investment (ROI). This calculation serves as the base from which all informed investment decisions are made, and although the calculation remains constant, there are unique variables that different types of investment bring to the equation.

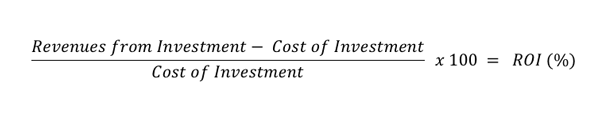

In order to calculate ROI, the formula is simple which is simply take the gain or revenue of an investment, subtract the cost of the investment, and divide the total by the cost of the investment. The result is expressed in percentage or ratio. The ROI formula is as follows.

https://www.itassetmanagement.net

ROI is measured as a percentage and it can be straightforwardly compared with returns from other investments, allowing one to measure a variety of types of investments against one another.

To exemplify, suppose Joe invested $1,000 in Google Corp. in 2010 and sold his shares for a total of $1,200 a year later. To calculate the return on his investment, he would divide his profits ($1,200 – $1,000 = $200) by the investment cost ($1,000), for a ROI of $200/$1,000, or 20%.

He could compare the profitability of his investment in Google with other investments with this information. For example, Joe also invested $2,000 in Tesla in 2011 and sold his shares for a total of $2,800 in 2014. The ROI on Joe’s holdings in Tesla would be $800/$2,000, or 40%. By using ROI, Joe can easily evaluate the profitability of these two investments. Joe’s 40% ROI from his Tesla holdings is twice as large as his 20% ROI from his Google holdings, so it would show that his investment in Tesla was more profitable and the wiser move.

Thus it can be concluded that the Return on Investment (ROI) is a calculation that is commonly used by organisations to help them to decide whether they should make a particular investment or not. In fact, ROI is a very popular metric because of its versatility and simplicity. Basically, return on investment can be used as a simple estimate of an investment’s profitability. ROI can be very easy to calculate and to interpret and can apply to a wide variety of kinds of investments. That is, if an investment does not have a positive ROI, it means it has too little or no return. If an investor has other opportunities to compare other options available with a higher ROI, then these ROI values can give information as to which investments are preferable to others.

More from my site